# The Sui Blockchain: Objectively Overhyped?

Sui is being pitched as the next generation of Web3 infrastructure, and its object-oriented design is getting a lot of attention. The marketing emphasizes low latency, stable transaction fees, and high throughput. But let’s pump the brakes and look at what this really means. Is Sui actually delivering on its promises, or is it just another blockchain riding the hype cycle?

Object-Oriented: Novel, But Is It Revolutionary?

Sui's core selling point is its object-oriented design. Everything on Sui is an object, allowing developers to create application-specific object types with network-wide compatibility. The pitch is that this changes how assets and protocols work together, creating greater composability. Okay, but how does this translate to tangible benefits for users and developers?

Parallel Transaction Execution: Claims vs. Reality

The claim is that Sui's object-oriented approach enables parallel transaction execution. Explicitly defined transaction dependencies allow Sui to execute transactions in parallel, significantly improving network performance. They're saying many transactions are finalized and settled in less than half a second while maintaining high throughput and stable transaction fees.

However, several blockchains are already implementing parallel processing, including some Layer-2 solutions on Ethereum. Sui isn't alone in this race, and the speed gains need to be benchmarked against these existing solutions under real-world conditions, not just in controlled tests. (And let's be honest, every blockchain brags about its speed in controlled tests.)

Overcoming Web3 Barriers? Maybe, But Show Me the Adoption Numbers

Sui touts solutions for common Web3 adoption barriers like wallet onboarding and transaction fees. They're pushing tools like zkLogin and sponsored transactions. zkLogin allows users to create and manage Sui accounts with a simple web login like Google, using zero-knowledge cryptography. Sponsored transactions enable applications to cover transaction fees for users, removing a significant friction point.

Adoption Metrics: The Missing Piece

These tools could lower the barrier to entry. But tools alone don't guarantee adoption. Where's the data on user growth and transaction volume? How many users are actually using zkLogin, and how much are sponsored transactions increasing user engagement? Without these metrics, it's just marketing fluff.

Move Programming Language: Security Claims Under Scrutiny

Move, the programming language on Sui, is tailored to Sui's object-oriented data model, creating a development platform that combines a new yet intuitive platform with a powerful and secure programming language. The claim is that Move on Sui helps to mitigate common smart contract exploits. But every new language claims to be more secure than the last.

I've looked at hundreds of these blockchain pitches, and security claims always need to be taken with a massive grain of salt. The real test is time and battle-hardening. How many audits have been conducted on Sui-based smart contracts? What's the track record of Move in preventing exploits compared to Solidity (Ethereum's language) over a comparable timeframe? Again, data is king.

A Dose of Skepticism

Sui’s architecture is definitely innovative, but the real-world impact remains to be seen. The object-oriented design and parallel execution have the potential to improve network performance, but rigorous benchmarking against existing solutions is needed. The tools for overcoming Web3 adoption barriers are promising, but user growth and engagement metrics are essential to validate their effectiveness. Move on Sui may offer enhanced security, but a proven track record and thorough audits are crucial.

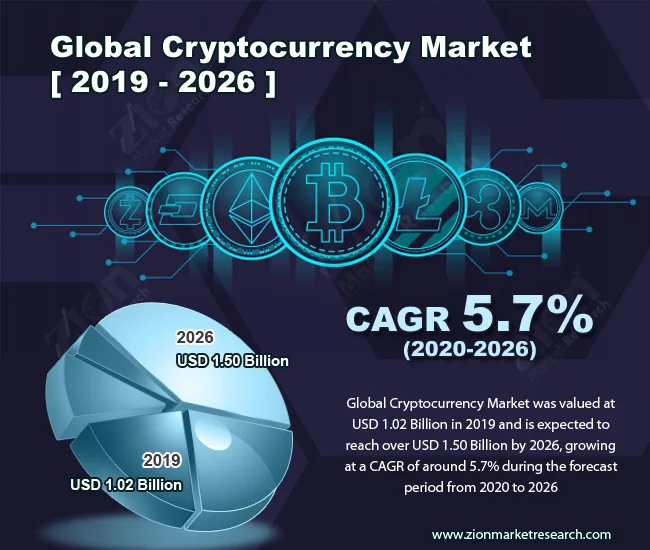

Regulatory Clarity and Institutional Adoption

The broader crypto market is seeing increased regulatory clarity, with stablecoins and institutional adoption gaining momentum. As the US under the Trump administration reshaped the global policy tone, crypto regulation entered a period of accelerating implementation and growing maturity. This regulatory clarity is creating tailwinds for institutional adoption, with financial institutions in about 80% of jurisdictions announcing new digital asset initiatives. If Sui wants to be a player, they need to show how they are playing within these new rules.